Don't waste your time. Get a loan online.

Best payday loans for bad credit

What is a Payday Loan?

A payday loans for bad credit (also known as a paycheck cash advance) is a way for workers with bad credit to borrow a modest amount of money over a short repayment term tied to their next paycheck, usually one or two weeks. It can come in handy as an emergency loan when you need money before your next payday. It is neither a secured personal loan nor a car title loan, but rather a loan based upon proof of your regular income.

You repay Payday loans for bad credit all at once, on the due date. Normally, the lender will debit the money directly from your checking account.

If you have insufficient funds in your account, you’ll be hit with an NSF penalty from your bank and late fees from the lender. You’ll then have to rollover your loan to your next pay cycle, triggering more fees and interest charges.

The main reason to get a payday loan is that your minimum credit score is much less important than your income. Some lenders may even skip a hard credit check as long as you can document enough reliable income to show you’ll be able to repay the loan on time. This is important because, unlike a secured loan or car title loan, a paycheck cash advance is an unsecured loan without the backing of collateral.

Don't waste your time. Get a loan online.

You may not be in a position to come up with a lump sum repayment of a payday loan due in one or two weeks. If so, consider an installment loan instead. This is a bad credit personal loan with a monthly payment term lasting three to 72 months.

Typically, a personal loan charges a lower interest rate than that associated with payday loans but is more likely to require a credit check. A personal loan takes longer to repay, so the interest can mount up over time. Keep in mind that 85% of payday loans get rolled over at least once, so they too can suffer from swollen interest charges.

Where Can I Get a Payday Loan?

While you could go to a local brick-and-mortar payday advance store to get your money in a few minutes, it may be more convenient to obtain your loan online if you can wait until the next business day.

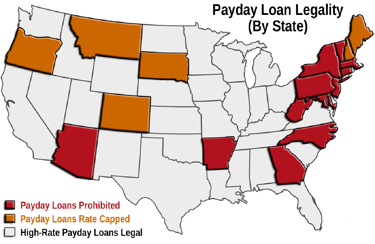

Naturally, you must live somewhere reasonably close to a payday store to get an in-store paycheck cash advance. Some states outlaw payday loans, so getting one may require you to travel to a neighboring state.

Most of the reviewed lenders provide personal loans instead of, or in addition to, payday loans. Only one, Utah-based CashAdvance, is strictly devoted to payday loans. MoneyMutual offers both types of short-term loans.

Online Best payday loans for bad credit are available in most states, but you’ll have to check with the lender to see if your state is eligible. The states of Connecticut, Maryland, Massachusetts, Pennsylvania, Vermont, and West Virginia never permitted payday loans, and the District of Columbia repealed its permission.

Can I Get a Payday Loan if I Have Bad Credit?

When you use an online lender-connection service, it’s normally assumed that you have bad credit. This article reviews seven online bad credit loan services for consumers with bad credit. They all share a similar two-step application process for a paycheck cash advance or short-term unsecured personal loan — pre qualification and application.

You can kick off the pre qualification process by completing a loan request form or online questionnaire. This step does not require a hard pull of your credit files, and therefore will not affect your credit rating.

The pre qualification step determines whether you meet the minimal requirements, which include:

- U.S. citizenship or permanent residency

- Being at least 18 years old

- Reliably collecting no less than the minimum required monthly income, subject to verification

- Having an email address, active checking account, and a telephone number

- Optionally, you may also have to provide your Social Security number and records showing your monthly payment for rent/mortgage and current debts

If you pass the pre qualification step, the lending-connecting service will check its network for an appropriate direct lender that is the most likely to approve your request. You’ll then be transferred to the direct lender’s website and the loan application step will begin.

The direct lender’s loan application form is more detailed than the pre qualifying loan request form. Sometimes, the connection service will pre populate the application with the information it gathered from the request form. You’ll then be asked to fill in any other required information.

Most of the direct lenders will perform a hard credit check. Each Hard credit check may lead your FICO score to drop five to 10 points, but the damage lasts no more than one year. So best option individual borrower has is to go to lender connecting services sites so that they can get your few basic details and try to find lenders which are ready to give you required money so you end up having one soft credit check(which does not reflect on your credit report) and one hard credit check and you are done.

If the lender approves your application, it will give you a loan option list containing the loan term, loan amount, interest rate, fees, and so forth. This is your opportunity to examine the fine print before signing the loan agreement. Within one to two business days, your loan proceeds will be deposited in your account at your bank or credit union.

There is always the possibility that a lender-matching service will be unable to find a direct lender willing to offer you a loan. Nonetheless, you may receive referrals to other debt service companies, such as those offering debt consolidation or debt relief.

Honest lender-connecting services never charge a fee. They instead make their money by collecting finders’ fees from direct lenders. Truthfully, it’s often said that payday loan interest rates are far too high even for a high-risk borrower, and we couldn’t agree more.

How Can I Get a Loan Without a Credit Check?

It is possible to get a loan without a credit check, but the option is not universally available. A credit check involves the collection of payment data and other information. Also, some lenders only require a soft credit check, whereas others require a hard credit check.

- A soft credit check doesn’t harm your credit rating. When you check out your own credit rating, the inquiry will always be soft. This also pertains to credit checks run by parties other than those attempting, with your permission, to open a new account.

- A hard credit check is only used when you authorize a third party to open a credit account — a loan or a new credit card, for example — on your behalf. Most loan applications include fine print stating that your loan request automatically grants authorization to the lender.

Payday loans may not require a hard credit check, but personal loans usually perform a hard check. In both cases, pre qualification may require just a soft credit check.

Bear in mind that pre qualification doesn’t mean you’ll get the loan, but it certainly is a hopeful sign. The decision to approve or decline a loan application rests with the direct lender, not the loan-matching service. The lender is ultimately responsible for approving loans and setting terms.

A payday lender is more interested in your ability to repay a loan than your credit record. For bad credit consumers, payday loans may be easier to obtain than personal loans. However, if no credit check is done, you won’t have the opportunity to improve your credit score by having your on-time payment transactions posted to a credit bureau.

In other words, if you want the benefits of payment tracking from a credit bureau, you’ll have to submit to a hard credit check.

A no-credit-check loan usually carries a higher interest rate than loans that pull your credit. There’s nothing mysterious going on — when you ask a lender to ignore your credit history, you are admitting that the history is unfavorable.