Don't waste your time. Get a loan online.

You might have applied for your PPP loan months ago, Received your PPP loan, and are now in the process of preparing to submit your loan forgiveness application once your lender is ready to accept it.

Paycheck Protection Program & How to calculate FTE/FTEE for it.

Borrowers who received a PPP loan before June 5, 2020 can elect to calculate their eligible costs using either an 8-week or 24-week Covered Period.

Borrowers who received their PPP loan on or after June 5, 2020 must use the 24-week period. Any Borrower who files a loan forgiveness application using a 24-week Covered Period can file their loan forgiveness application before the end of the 24-week Covered Period.

Full-Time Employee equivalent, As businesses have stated to collect their Paycheck Protection Program (“PPP”) loan covered period or decide whether to extend a little longer, The very first question comes here is the full-time employee equivalent (“FTE” or “FTEE”) calculation.

Don't waste your time. Get a loan online.

So you have One condition to getting your Paycheck Protection Program loan completely forgiven is by proving that you maintained the same number of FTEs (full-time equivalents) during the 24-week PPP period as before COVID-19.

Your FTE figure will not necessarily be the same as the number of actual people you had on payroll, especially if you had turnover and part-time employees. Using the FTE measurement will give you a more accurate view of your labor force.

Self-employed individuals with no payroll do not need to worry about calculating FTE. Self-employment PPP is based on 2019 net profit, not payroll numbers.

First, Determine which Loan Forgiveness Application Form to file – Form 3508 or Form 3508 EZ

Before you worried about how to calculate FTEs, You should know which form to file, as this will impact the computations the Borrower will need to perform for purposes of calculating loan forgiveness.

Does the Borrower meet the requirements to file Form 3508 EZ (the short-form filing) or will the Borrower be required to file Form 3508 (the long-form filing)?

If the Borrower meets one of three criteria as provided on Form 3508 EZ Instructions, they are able to avoid calculating an FTE Reduction Quotient (as discussed below). However, Borrowers who file Form 3508 EZ by meeting the second set of requirements (checking the second box on page 1 of Form 3508EZ), are still required to calculate FTEs, but as of January 1, 2020 and as of the last day of their Covered Period.

Key Definitions:

When calculating FTEs, it is critical that you know certain definitions:

- FTE

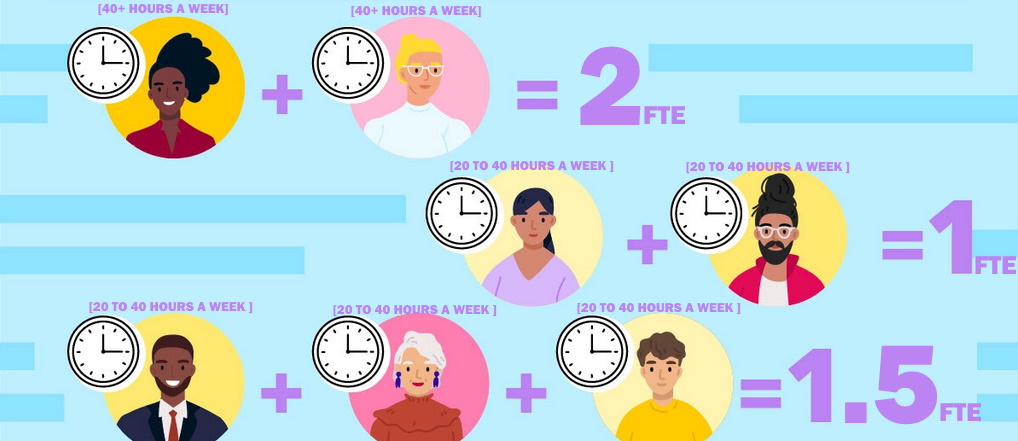

The Small Business Administration (SBA) defines a Full-Time Equivalent employee [FTE] as “an employee who works 40 hours or more, on average, each week.” The hours of employees who work less than 40 hours are calculated as proportions of a single FTE employee and aggregated. The calculation of an FTE is explained in more detail below.

- Covered Period

The Covered Period is either (1) the 24-week (168-day) period beginning on the PPP Loan Disbursement Date, or (2) if the Borrower received its PPP loan before June 5, 2020, the Borrower may elect to use an 8-week (56-day) Covered Period. Borrowers using the 24-week Covered Period can file their loan application before the end of the 24-week period. In no event may the Covered Period extend beyond December 31, 2020.

- Reference Period

The Reference Period for FTEs is either (i) February 15, 2019 to June 30, 2019, or (ii) January 1, 2020 to February 29, 2020. The Borrower can choose which reference period is most beneficial to them (i.e., results in a lower FTE). Seasonal employers have a third period to choose from, which can be any consecutive 12-week period from May 1, 2019 to September 15, 2019.

Calculating FTE

Each employee that on average, worked more than 40 hours a week during the particular calculation period, counts as one FTE. One employee cannot be greater than one FTE— overtime does not apply.

Part-time employees that did not work more than 40 hours on average will have their average weekly hours worked added together. Divide by 40 and round to the nearest tenth to get your FTE calculation.

For example, if you have 3 employees who consistently worked 20 hours a week. Following is calculation for counting their combined FTE.

20 Hours X 3 Employee = 60 Hours

Devide it with 40 Hour, result is your FTE

60 / 40 = 1.5 FTE

Hence,altogether they would count as 1.5 FTE.

Sum up your full time FTE and Part time FTE to get you final FTE.

For simplicity, when filing the forgiveness form you are allowed to use 1.0 FTE for full time employee who works more than 40 hours a week for your business and 0.5 FTE for any other employee who works part time for you. which ever is convenient for you, but you have to be consistent while providing data whichever method you use to count your FTE.