Don't waste your time. Get a loan online.

Easy Loans No Credit Check Are you eligible ?

Consider these factors when applying for an Easy Loans No Credit Check

When shopping for a loan with bad credit or no credit, there are some things you should be aware of.

If you are looking for a lender that specializes in this type of credit history, the following criteria should be considered:

- Customer service reviews/ratings

- Methods of repayment

- Penalties and fees

- Lender terms

- Rates and types of interest

- Eligibility requirements: i.e. monthly income, employment status etc.

Let’s take a look at these criteria.

Customer Service Ratings/Reviews

You should take the time to review other customers’ opinions about this loan service. There will be some disgruntled customers. This is because a few people didn’t read the terms and conditions of their loan carefully. However, the majority of reviews should be fair to excellent.

Don't waste your time. Get a loan online.

It’s also a good idea to do some quick research on the company you’re interested in by checking out the Consumer Financial Protection Bureau to see what customers have to say.

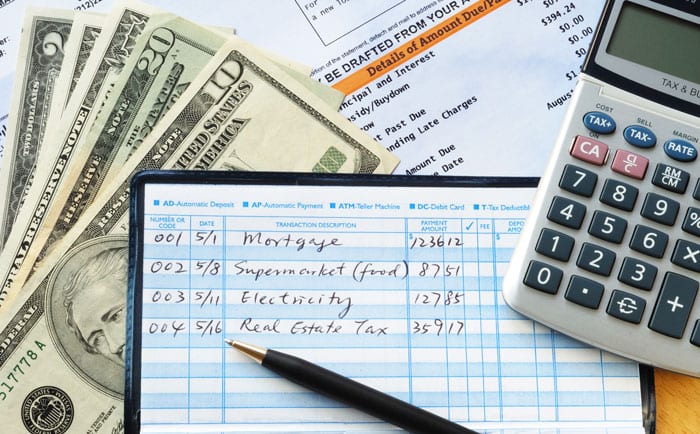

Methods of Repayment

Lenders offer many repayment options to make things easier and ensure that they get their money back with interest. Automatic payments from your checking account are one option. In some cases, you might get a discount.

You can also pay online with your bank information or mail checks. Check with your lender to ensure that they have a solution for you.

Penalties and fees

Your loan could be affected by a returned check, origination fees, prepayments, late or insufficient funds and processing fees.

Lenders who have to process the loan are subject to origination fees. Some lenders do not charge this fee, but most will. This fee could be added to your loan or as an additional charge. This will vary depending on the lender and your state.

The lender may also charge a prepayment penalty fee. This fee can wipe out any savings you had hoped to make by paying it off earlier. The fee is typically a percentage of the remaining balance or the total interest charges over several months.

Late payments will result in a penalty. Some lenders offer grace periods, but make sure you check with your lender before accepting. Call your lender if you are certain you will be late to avoid paying a penalty.

Late fees can be expensive. Some lenders may charge $30, while others will charge a percentage of your monthly payment (around 5% in most cases). Late fees are not charged by all lenders.

Loan Terms

You will be provided with the terms of your loan. This includes your APR, loan restrictions and loan term. You should carefully read them and ensure that you understand the terms.

Rates and types of interest

Compare interest rates to find the best loan rate. In most cases, the interest rate will be lower if you have a good credit rating.

Fixed interest rates are a common feature of bad credit loans companies. This guarantees that they will remain the same throughout the term of the loan.

Variable rate loans will fluctuate according to the index rate.

Eligibility requirements for Easy Loans No Credit Check

Lenders who specialize in loans without credit will often require a credit score of at least 620. The maximum ratio of debt to income is typically capped at 45 percent. This is the ratio of how much you owe to each month and how much you earn.

Lenders will often advise borrowers to have steady income to cover their poor credit. You may be required to earn a minimum amount annually to be able to work for some lenders.

When assessing your ability to repay the loan, lenders will consider your income and your employment. When determining your financial responsibility, some lenders may also consider other financial factors such as your savings. If you are a person with poor credit and no debts, you can get a loan to pay for your needs.

These companies might also require a cosigner. If they have good credit or good income, a co-signer may be able to get you a lower interest rate. If you default on your loan, the co-signer will have to pay the bill. This could cause a strained relationship and damaged credit for the cosigner. Before signing, make sure you both understand the terms of the loan.

Step by step guide on how to get Easy Loans No Credit Check

A better deal could be achieved if you have some understanding of the loan process. To ensure that you don’t end up paying more for a bad credit loan, let’s first go over some steps.

- Begin by checking on your credit score and getting your credit report. Check your credit report for errors. Then, look for ways to improve your score. You can fix any errors found in your credit report and improve your credit score. This could result in a lower interest rate. By going to annualcreditreport.com, you can use the three major credit organizations to get your score.

Your creditor will use your report to determine if you are able to repay the personal loan. It is best to check your report three months before applying for a personal loan. This will allow you to correct any errors. For best results, you should dispute them with all three bureaus.

You can improve your credit score by paying off any credit that exceeds 30% or settling a collection debt.

Determine your budget. Find out how much money you can borrow. Next, create a plan for making sure that the payments are on time. You should ensure that your budget covers your basic needs, such as food, housing and transportation, credit card payments, and savings.

When calculating how much you can afford each month, consider the amount and repayment period. Interest is charged at a higher rate the longer you take to repay the loan. The APR of your loan, as well as the interest rate, will affect the monthly payment. You should also consider any fees associated with the loan (such as origination fees).

Compare to find the best interest rates. A personal loan is not something you can just do. You should take the whole process seriously and research the best rates. Online lenders are able to pre-approve you, which will let you know what the interest rates of lenders.

Pre-approvals, which are not hard pulls on credit reports, are vital quotes. They are designed to show you the interest rates available for people with credit scores similar to yours. This is a great way to compare interest rates and terms for bad or no credit loans before you apply. However, applying will result in a hard pull of your credit report which could affect your score.

It is a good idea to seek pre-approvals from as many lenders that do soft pulls on credit. This will enable you to compare rates and make an informed decision about which one is best for you. You will only need to do one pull, so your score won’t be affected.

- Beware of scams and fraud. Scammers are out there and want to take your money. Although it’s not easy to do, remember that if something seems too good to be true, it most likely is.

Scammers are likely to asks for upfront fees, contacts you non-stop, doesn’t care about your payment history, requests that you pay with a prepaid card or can’t produce a license to lend money in your state.

- Payback your loan. Some lenders will fund you within the next day. Once the money is disbursed, it is your responsibility to repay it.

To avoid paying late fees and lower credit scores, make sure you pay your loan on time. You will be charged more interest and your loan amount if you pay after the due date. To ensure that you are able to pay your loan back on time, it is important that you calculate the numbers before you apply.

Alternatives to No Credit Check loans

Online loans without credit checks are not necessarily bad, but there are risks. Before you sign any paperwork, it is a good idea to look into other options. These are some options you might consider.

Peer-To-Peer Lending

Individual investors can fund these loans instead of large financial institutions. This option could lead to a better deal.

The interest rate works the same as any other loan. However, your credit score will determine how much you get. It is almost certain that terms will be more favorable than payday loans which have a higher rate and additional fees.

What if you don’t qualify?

You may not be eligible for a loan with bad credit. You may also have read this article, and decided it wasn’t for you. It’s okay. You have other options to make money so you can buy what you want.

Contact Your Company

Call them if you are in debt to a utility company or credit card company.

A hardship plan may be available to help reduce monthly payments and interest charges. As an exception, a utility company may allow you to pay half of the bill immediately and the remaining half within two weeks or next month.

This could save you from taking out a loan in the first instance.

Home Equity Line of Credit

This is abbreviated HELOC and allows you to tap into your equity in order to get cash for the things you need.

You will receive a credit card, or a check, when you apply for such a loan. This money can be used to pay your bills during what is called a draw period’.

After that, the credit line is converted to “repayment,” in which you repay any remaining balance either over time or immediately, depending on your HELOC terms.

Take the time to review your budget

If possible, cut down on the amount of small loans you take out. People who are able to quickly get out of debt do so by making extreme sacrifices in order save every dollar.

This means that you don’t need to spend extra money on food or clothing, luxury/unnecessary spending is prohibited, as well as going out unless the activity is paid for or free. This includes no cable TV, Netflix, or, if you have a very tight budget, no internet.

Although it may seem harsh, this is an effective way to get out of debt. Most people can get rid of unnecessary expenses by cutting down on eating out, shopping less and buying things on impulse.

To make extra cash, you can also sell things that you don’t use. You can raise money online through sites such as eBay, Mercari and Facebook Marketplace.

Paycheck Advance

This is not possible for all employers, but it is possible. A cash advance can be made on your paycheck. This is dependent on the employer but it’s worth looking to see what they can do.

Side hustle

Do you have extra time? You’re a good person and you can moonlight. Whether it’s delivering pizzas, making homemade handicrafts and selling them, doing freelance writing/artwork/video editing online, or something else that makes money safely and legally, get going. It’s possible to feel tired from a long day at work, but it’s much better than receiving calls about debt collection throughout the day.

Family and Friends

You should be careful about this one as it could damage your friendship with a family member or friend. It is important to take it seriously. Get it down on paper. Set up terms you can follow, including payment amounts, interest and due dates.

It is best to treat it as if you were dealing with a bank. You might also offer childcare, labor, or other services to help pay off your debt.

FAQs about Easy Loans No Credit Check

Q. Q. Can I get an Easy Loans No Credit Check?

To determine if you are eligible, most lenders will check your credit score. Other lenders might use other verification methods such as artificial intelligence or bank information to determine if you are eligible for a loan.

Q. Q. Does taking out Easy Loans No Credit Check affect my score if I have poor credit history?

Scores are affected by the time a person submits a loan request. However, timely payments can help rebuild your credit score. You must make sure that you pay your monthly bills on time. If you have the funds, you might consider adding a few dollars to your payment.

Q. Q. Do you know of any Easy Loans No Credit Check that have guaranteed approval?

No matter your credit score, there is a good chance that a lender around the globe will approve you. However, these loans often come with lower interest rates and terms than you might like.

Q. Q. What are some examples of loan rates for borrowers with bad credit?

If your credit score isn’t great, you can still get personal loans. We’ve even seen applicants with scores as high as 450. If your credit score is below “good”, the interest rates can go up to 20%.

Q. Q. What can I do to get an Easy Loans No Credit Check?

You are best to choose a lender that uses alternative data such as income and banking history to make decisions.

Q. My credit is not good enough to get an emergency loan. How do I get one?

These lending companies can help you get a loan. Select the best network for you and fill in all information. There will be offers from many lenders so you can choose the one that interests you most.

The application will be completed and submitted. You will receive your funds in no time. Usually, your money is available the next day. These lenders offer automated underwriting services that allow you to apply for loans 24/7.

Q. I am unemployed but need an Easy Loans No Credit Check. Are You Out Of Luck?

The answer is yes. Lenders want to know that you can repay your loan. Lenders are looking for income from rentals, alimony or retirement pensions/accounts as well as government payments and investments. You should consider applying for these loans even if your income comes from student aid, annuity, or child support.

Q. These numbers are not listed on the website of lenders because they consider more than your score to determine if you are eligible.

You might have great credit but lots of debt. Lenders will reject applications if they feel that the borrower’s income cannot cover additional loan payments.

Someone could have poor credit but not much debt. Lenders will approve an application if the applicant has sufficient income to repay the loan. However, they may charge an origination fee or a higher interest rate.

Lenders might also look at your employment history. Lenders look for stability and if you have been with the same company for a while, don’t change jobs often, that’s a sign you are stable. This means that there are no gaps between your paychecks, and your income is stable.

Q. I don’t have any credit, what is my score?

Your report won’t show you a score if your credit is negative. This is because there isn’t enough information to create one.

This is known as “credit invisibility” and it will result in a score. Once you have received your first loan or credit card, and have 3-5 month of repayment history reported to the major bureaus, you will be able to create a score. Your lender can report to any or all of the credit bureaus when you get a loan.

Let’s conclude: Which company is the best for Easy Loans No Credit Check?

You’ve now learned about the basics of no-credit check or bad credit loans. Will you be applying for one? Which service will you use first?

It’s much easier to get a loan now than in the past. Online lenders are able to assess your credit and offer loans without you having to speak with a bank representative.

We prefer platforms such as MoneyMutual and BadCreditLoans , Motiveloan to be the most trusted sites.

These are legitimate lending outlets so there is no risk of scammers getting your personal data. Make sure to have a plan for paying it back, and that you make all payments on time. Good luck!