Don't waste your time. Get a loan online.

COVID-19 Economic Injury Disaster Loan

What is Economic Injury Disaster Loans?

The SBA disaster loans are the main form of Federal assistance for the repair and rebuilding of non-farm, private sector disaster losses. The disaster loan program is the only form of SBA assistance not limited to small businesses.

The Economic Injury Disaster Loan Program (EIDL) can provide up to $2 million of financial assistance (actual loan amounts are based on amount of economic injury) to small businesses or private, non-profit organizations that suffer substantial economic injury as a result of the declared disaster, regardless of whether the applicant sustained physical damage.

An EIDL can help you meet necessary financial obligations that your business or private, non-profit organization could have had if the disaster not occurred. It provides relief from economic injury caused directly by the disaster and permits you to maintain a reasonable working capital position during the period affected by the disaster. EIDLs do not replace lost sales or revenue.

Who is eligible for Economic Injury Disaster Loans?

To be eligible for EIDL assistance, small businesses or private non-profit organizations must have sustained economic injury and be located in a disaster declared county or contiguous county. there is no other requirements to be full filled as of now.

Don't waste your time. Get a loan online.

More than 3.7 million businesses employing more than 20 million people have found financial relief through SBA’s Economic Injury Disaster Loans, which provide low-interest emergency working capital to help save their businesses, However, the pandemic has lasted longer than expected, and they need larger loans.

said SBA Administrator Isabella Casillas Guzman in a news release.

The SBA has approved more than $200 billion in COVID-19 EIDL loans. The loans have a 30-year tenure with interest rates of 3.75% for individuals having small business,though this rate won’t exceed 4%, It will be 2.75% for not-for-profits organization.

The announcement of the higher loan limits came less than two weeks after the SBA announced March 12 that it was extending deferment periods for all its disaster loans, including the COVID-19 EIDL loans. Thanks to that decision, COVID-19 EIDL recipients won’t have to start making payments on their loans until 2022, though borrowers may voluntarily continue to make payments during the deferment as interest will continue to accrue on the outstanding loan balance.

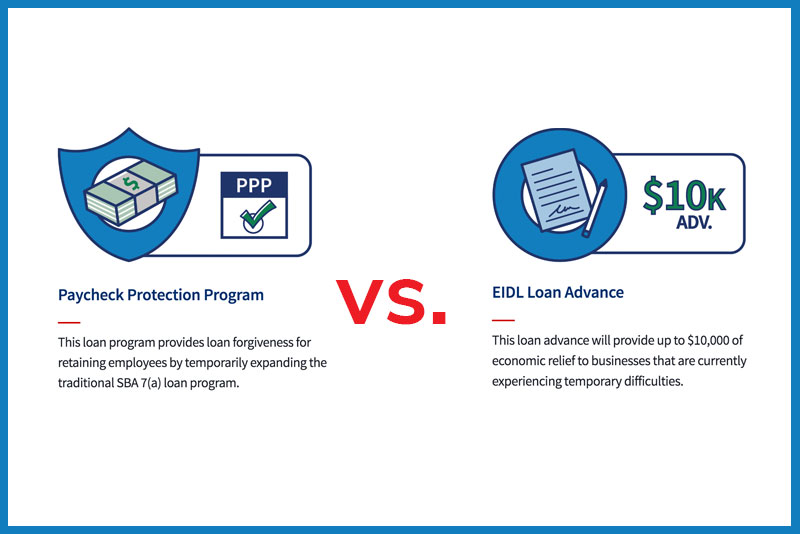

EIDL VS PPP Loans: What’s The Difference?

Businesses affected by COVID can apply for loans through the EIDL and PPP programs, which were funded by the CARES Act in 2020 until the funds ran out in August. The $900 billion stimulus package passed in late December revives and restructures a number of COVID-related relief programs, including PPP.

While the main part of the EIDL has to be repaid with max rate up to 4% in interest, the $10,000 EIDL advance is automatically forgiven. PPP loans can reach up to $10 million and are 100% forgivable if the borrower follows loan forgiveness rules laid out by the SBA. You have to be spend it as per rules set by government for PPP to be forgiven.

PPP loans can also be used for operational expenses, but their primary purpose is to cover eight weeks of payroll. To qualify for forgiveness, you must spend at least 60% of the loan on payroll expenses. You can also use a portion of the loan to cover mortgage, rent, or utility expenses.

How Economic Injury Disaster Loans Work

An EIDL can be used on payroll costs, employee benefits, fixed debts (such as mortgages, rents, or leases, accounts payable), and other bills. If you receive the forgivable grant, you need to spend it on those same expenses within eight weeks of receiving the grant — i.e., in the amount of time that it will likely take before the main loan comes through.

Also called “Working Capital Disaster Loans,” EIDL funds are issued directly from the US Treasury, and you can apply right on the SBA’s website.

What are the loan terms for Economic Injury Disaster Loans?

The SBA can provide up to $2 million in disaster assistance to a business. The $2 million loan cap includes both physical disaster loans and EIDLs. There are no upfront fees or early payment penalties charged by SBA. The repayment term will be determined by your ability to repay the loan.

| Max Loan Length | 30 years |

|---|---|

| Interest Rate | Cannot exceed 4% |

| Max Loan Amount | $2.0 million |

| Payment Frequency | Varies |

| Prepayment Penalties | Varies |

| Max Loan Length | Varies |

How do I apply for Economic Injury Disaster Loans?

Apply online for disaster loan assistance at your own convenience through SBA’s secure Disaster Loan Assistance website.

For application information, please call 1-800-659-2955 or email DisasterCustomerService@sba.gov.