Don't waste your time. Get a loan online.

Loans for people with poor credit is the thing which is generally under served market as banks and credit unions have enough business without dipping into that particular high-risk pool.

Loans for people with poor credit

There is no spending rule for personal loan, hence people borrow money with Personal Loan Product for number of reasons, such as sudden medical expense, consolidate high interest credit card debt. or taking vacation or even home improvements.

But if your credit score is at bordered at less that perfect credit score than you may find difficulties getting borrowed from traditional lenders, which are your regular banks and credit unions.

You can finalize with payday lenders that loan money for short periods of time at very high interest rates, or you can investigate the growing number of online only lenders that focus on loans for people with bad credit.

Don't waste your time. Get a loan online.

New influence in the world of finance

Fortunately, innovative technology comes around and now online only lenders are available to offer loans for people with poor credit. They focus on the niche between traditional installment personal loans and short-term payday loans. Motiveloan is one of the such lender if you wish to try your luck go ahead with what motiveloan has to offer you, you might get surprise with what offer will be pre qualified for you with credit score range you resides.

Factor that affect your loan profile : Debt To Income Ratio

Lenders prioritize Credit score to take decision of lending but over the time they learnt that your credit score is just one factor that covers only one part of risk assessment.

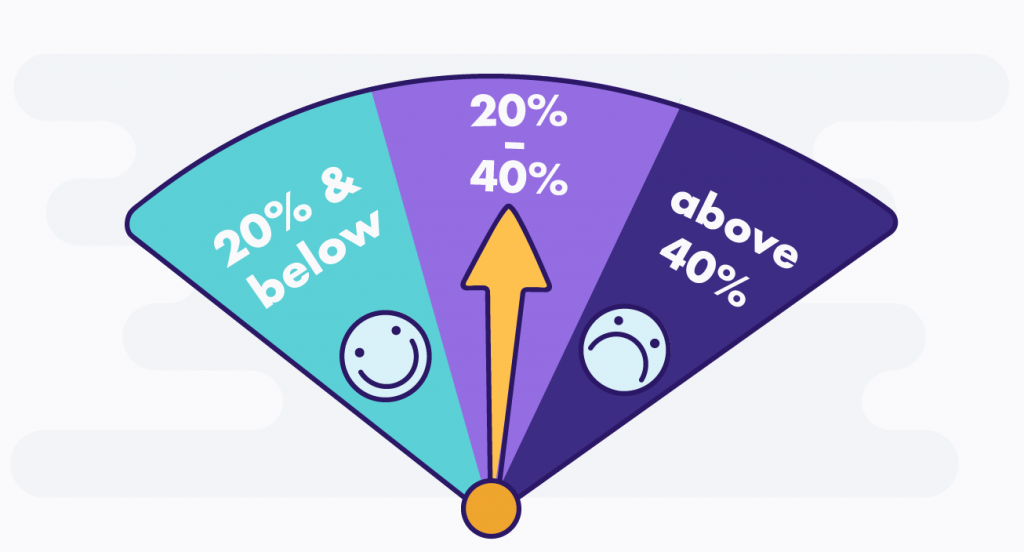

Debt to Income ratio is also most important factor that they consider, they make sure that your income is stable until your loan account as per agreed repayment tenure. Generally your debt to income ratio should be 20% at max, means your monthly EMI should not exceeds your monthly income’s 20%. This way your EMI won’t shake your monthly budget and you can payback on time without any burden.

Secured personal loans for people with poor credit

If lender does not approve your loan for your credit score and you don’t want to go with higher Interest rates we suggest you to go for secured loans, that will allow you to put some of your valuable to back it up your loan account lowering the risk means better Interest rates from your lender. Since there is no need to check your credit score when you are opt for secured loan option. the lender has asset that can be possessed and cashed out in event of non payment.

Lenders & State Laws:

Not all lenders operates in all the states, so it is advisable to check with your lender if they serve your state or not. If yes then check their terms and conditions and verify that they are up to the mark and valid with your state laws.

Summery:

Nobody wants to pay a higher interest rate than he or she has to, so consider the purpose of your loan before applying. Is it for debts or upcoming expenses that require immediate attention, or can the loan wait until you have an opportunity to build up your credit score and receive a better rate? or you just want loans for people with poor credit? Only you can answer that question, but at least be sure to ask the question before you rush into any loan agreements. Motiveloan offers Loans for people with poor credit you must not waste your time looking around, just go and apply.

“Bad credit” does not necessarily mean “no credit.” You have alternatives, but be sure to check them out thoroughly. Review the terms to make sure that you understand all the fees and potential charges, and calculate the total amount of money you will pay over the life of the loan. Choose poorly, and you could be caught in a seemingly endless debt cycle. Choose wisely, and you could be on your way to improving your financial position while rebuilding your credit.