Don't waste your time. Get a loan online.

Low interest loans for bad credit, Are really saving you in this after covid-19 situation

What is Low interest loans for bad credit?

Everyone and anyone can face emergency and need to borrow cash no matter how sound his situation is, life is very uncertain and full of surprise for us all. In such covid-19 era, we’re all facing some sort of hardship towards our work life financial stability is not there as some of us lose their jobs and unfortunates even lose their savings on heath care.

In this pandemic least we can help one in need is we can offer low interest loans for bad credit, we have to trust our gut feelings of people’s credit worthiness and rely on trust that they will pay back on agreed terms later when they stabilize their financial condition.

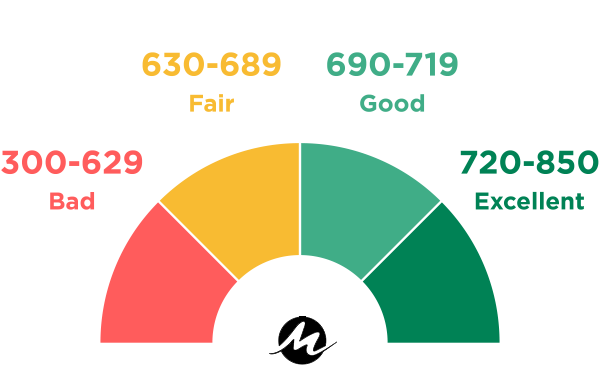

Here is small graphical representation of what number is associated with what kind of credit.

Having bad credit makes it harder to borrow money, and you’re likely to be saddled with high interest rates, high fees, and limited loan amounts. While a low credit score increases an unsecured loan’s overall cost, the loan can be structured with a longer term to make the monthly payments more affordable.

Don't waste your time. Get a loan online.

How to get low interest loans for bad credit?

Having bad credit is associated with very few chance of getting approved for any traditional loan source. for what you seek or at normal Rate Of Interest that normally obtained by great credit people. For bad credit people it best to go for lending matching service which matches you with number of lenders with single online application.

A bad credit lending matching service works with the several bad credit direct lenders, who has extensive experience working with sub prime borrowers. With this kind of service you are pre qualified for a loan by filling out online loan application form at service site , like one you find at motiveloan.com

In most cases pre qualification is subject to following requirements:

- Age: You must be at least 18 years old.

- Citizenship: You must be a U.S. citizen or resident and have a valid Social Security number.

- Income: You must reliably collect a specified minimum amount of income or benefits each month.

- Bank account: You must have an active bank or credit union account registered in your name.

- Identification: You must provide a Social Security number, valid email address, bank account details, and work and/or home phone numbers.

When you submit the loan application, then matching service matches your loan profile with one of the direct lender who can lend you. the matching website then redirects you to lenders website where you need to fill out few more details as per lenders requirement. lender then will perform hard credit inquiry to one of the big credit bureaus.

After evaluating your credit report lender will give you quick decision in few minutes with their Terms and conditions and rate of interest on borrowed amount. you are under no obligation to accept the offer though if you feel it’s not decent offer, That’s totally up to you.

What are the different types of low interest loans for bad credit?

Bad credit loans are focused of this content, they are known as signature loans, as you just need to sign the agreement while finalizing borrowing process, there is not collateral required to secure the loan. however some lenders also provide this way as well if you are not qualify for the loan amount required.

Credit card cash advances: Your credit card may allow you to take out a cash advance. The maximum you can borrow this way is usually some percentage of the card’s credit limit. Interest, which accrues daily starting on the transaction date, is usually higher than that of a personal loan but if you use credit card more often and paid off its amount in full before next due date then there is no penalties there and this is a perfect way to re build your credit.

The APR for credit card advances is also usually higher than the APR for purchases. The best thing about credit card advances is that they are available immediately without the need for approval. However, because these are expensive loans, they are best suited for short-term borrowing. At max you should use 30% of your credit limit provided by your credit card company.

Automobile title refinancing: This is similar in concept to home equity loans, except that it is secured by your car rather than your home.

These are refinancing transactions in which you borrow more than the balance due. You will get a new car loan to replace your current one, if any, with its own rates and terms.

Pawnshop loans: You can borrow against personal belongings at a pawnshop. Typical pawn items include cameras, laptops, watches, and jewelry. If you don’t reclaim your property after a set period, the pawnshop can sell it. These loans are very expensive because you usually can only borrow a small percentage of the pawned item’s value. We do not recommend this type of loan.

If all else fails, you may be able to borrow low interest loans for bad credit from your family or friends. Often these will be low- or no-interest loans with flexible terms. However, you risk your relationship with the lender if you don’t repay the loan.