Don't waste your time. Get a loan online.

Want online loans for poor credit score, in this covid-19 situation its hard to get one but we’ll guide you through your best bet.

Getting approved for credit line or any kind of loan product is getting harder and harder this year. And if you have a credit score which is ranging in poor category as per creditor then it’s very difficult to get approved from lenders. as you are categorized under the group called sub prime customers which likely potential threat to the lenders and any lender that don’t want to take risk face hard time lending to those sub prime members.

In action of certain events in 2020 banks and financial institutions tightened lending policies as they won’t bear any losses in middle of pandemic. They have changed lending policy for mortgages, credit cards, auto and consumer finance according to Federal Reserve data.

What is Credit Score and how it affects while looking for online loans for poor credit score

Lenders and credit providers uses one’s credit score which is maintained by 3 big credit bureaus. This credit score defines your credit worthiness. If this score fall in the range of fair or poor then that means to lender that you might not pay their monthly repayment on time, or you might not pay the entire loan at all and get defaulter on it. so they choose safe side and not approve you for whatever your requirement.

Don't waste your time. Get a loan online.

And In case some lender show interest to lend you money then that might not be at best rates which is generally very high than that of good credit score people will get. Still this high APR is much lower as compared to payday loans out there. so if you got qualified for such bad credit personal loan then you should consider it as an opportunity and grab it. though you should borrow responsibly, like ask for amount which you can easily pay back in small monthly installment over the few month or years time period whatever term you and lender get agreed on.

| CREDIT RATING | FICO SCORE RANGE |

|---|---|

| Very Poor | 300-579 |

| Fair | 580-669 |

| Good | 670-739 |

| Very Good | 740-799 |

| Exceptional | 800-850 |

So this way that Loan account’s regular payment will bring back you in main stream, where most borrower borrow. Most Lenders uses different kind of credit reporting services weather you pay them on time or late, They gonna report both things, no matter it’s positive or negative, so such positive report will surely do you a favor and you will observer your credit score is soaring gradually with their positive reporting.

How to shop for online loans for poor credit score?

When you have decided to take financial support as opening new loan account you should first know where you are exactly now. so first of all you should check your credit score from all 3 credit bureaus, So that you can get your credit report without hurting your credit score, as this kind of credit check is considered as soft credit check and as this is just for consumer purpose only that wont be any scope of rejection and hence falling the score is not there is such inquiry.

So Now you have your credit report, you can use it to find your credit score and flaws in your financial habits. If you observe any thing unusual then try to correct it. This credit history shows your previous loan accounts, credit behaviors, late payments if any or even foreclosures of loan accounts. In this credit history if you see anywhere that you were defaulter for some lenders then you should contact them over call or in person, Make them aware of situation and ask for any possible resolution over this situation. they might help you with some partial payments or some fees and help you repair your credit report.

As you know your credit score now, you can check that, May you get pre approved for any offers with whatever your credit score is. Generally lenders offer pre approved offers as per credit score ranges. so getting qualified for pre approved offers is competitively make much sense.

Credit ranges can greatly influence the amount of interest you pay on a loan. Suppose, someone with a FICO Score of 500-589 will pay 16.4% interest on a new five-year auto loan, on average, while someone with a 690-719 score will only pay an average 5.39%.

Caution:

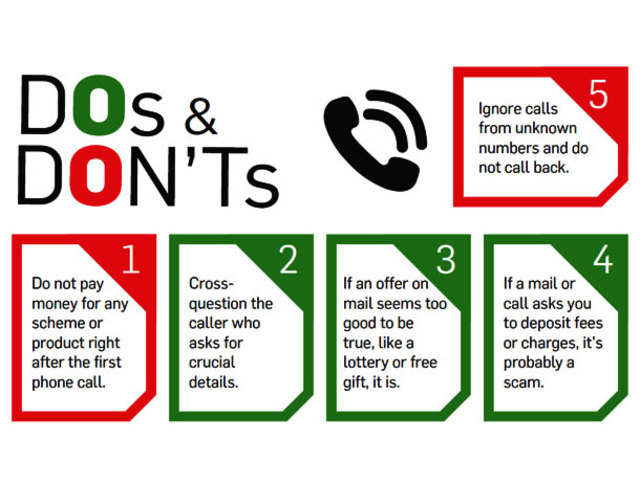

If you have poor credit, be sure about which lenders you turn to, potential scammers and illegitimate lending companies can view a low credit score as a potential target for their good.

You should avoid payday loans and title loans at all cost as they are the lenders who see poor credit score customers as their primary target, you know why? Let us tell you. They are looking for customers who left with fewer options to borrow money and frustrated due to rejection all over traditional sources.

So they are ready to lend you with APR approximately between 300% to 400%, which is generally for credit card is 15% and for personal loan 10%, that too with very short repayment tenure, give or take maximum 15 days. which might be your next pay day. this repayment make huge dent on your next pay check. you are shaken from the core as you can not manage your monthly budget with remaining amount.

So you consider roll over by just paying interest for the amount and lender make a new agreement over this with new fees that too with 400% APR, Like wise borrower of payday loan stuck in never ending debt cycle. and getting out of it is really tough. You better avoid one for your better financial future.

What are your option for online loans for poor credit score

Reach out to your current bank:

If you have established banking relationship then you can try to leverage that relation for loan, even though you have bad credit score. It is critical to have financial relationship with banking institution which hear your requirements.

This tactic is not so useful when we are talking about nationalize banks, however it could be starting point for what offers or rates you can qualify for. Smaller banking institutes or credit unions are more likely work on such levels and help you find which product might help in your particular situation. Credit union do have requirement of membership which is normally obtained by small donation to non profit organizations.

Find a Co-Signer:

If your credit score is not so good and not helping you secure a better loan terms or rates you can always co-sign the loan with trusted family member or Friend.

This might not be decision one should take lightly, Co-signing loan account means if you do not able pay that loan then your co-signer who is on hook, now is responsible to pay the loan. any late payment or penalties will results in credit fall for both the person who are registered borrowers under same loan account.

While you not able to secure online loans for poor credit score, Go for Payday Loan Alternative:

Instead of applying for payday loan you should consider Payday Alternative Loans (PALs) offered by credit unions

This small loans ranging from $200 to $1000, with tenures up to six month, installments are divided in multiple small installments. The rate of interest is generally high as much as 30% APR, higher than credit cards and personal loans, yet very affordable than that of payday loan which is 400%, So build solid repayment plan to pay off the debt, in this case PALs are viable and affordable loan option that payday loans.