Don't waste your time. Get a loan online.

What to know about personal loans for bad credit.

A low credit score is big red flag for lenders because they’re afraid you will miss payments or become completely defaulter. That’s why the interest rate charged for bad credit loans is higher than the interest rate charged for loans to people with good or excellent credit.

They simply want to cover up with their lending amount as soon as possible. so in case you do not pay them at certain point till then they have cover up majority of their amount with may be few profit, and any point they can choose to file a legal action against you and initiate recovery process with third parties so don’t take this as advice that you can simply become a defaulter and as they have earned enough from you, things don’t work like that we just want to say they don’t want any risk so APRs are higher, That’s it.

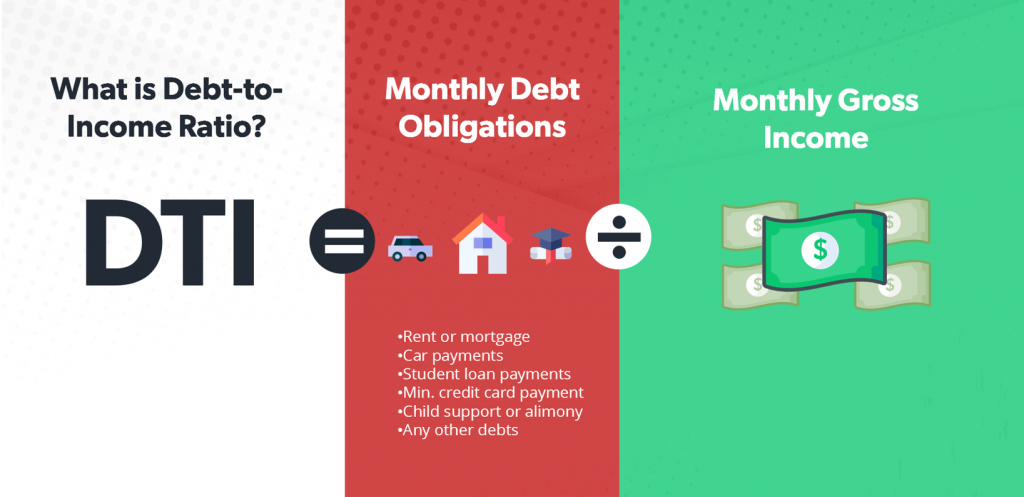

When you’re applying for a loan, Two primary things are most important: Your credit score and your debt-to-income ratio (DTI).

- DTI: Your DTI refers to how much you owe compared to your monthly income. For example, if you earn $5,000 a month and your rent, car payment, student loan, and credit card payments amount to $2,000, your DTI would be 40%. The lower your DTI, the more confident a lender will be that you earn enough money to make all your payments on time.

- Credit score: It’s a number between 300 and 850, indicating how well you’ve dealt with credit in the past.how well paid your debt on time, If you’ve been late on payments, suffered a foreclosure, filed for bankruptcy, or have too much debt in relation to your income, your credit score may be low. If you don’t have enough credit history for the scoring agency to give you a score, you’ll also need to look at loans for bad credit.as in that case your credit score is negative as you have nothing to prove your credit worthiness.

These will the most important factors which leads to whether or not you get loan approval for amount you applied for, as well as what loan terms and interest rates you qualify for.

Don't waste your time. Get a loan online.

Still, if you need a loan, the best personal loans for bad credit are far better options than, for example, a payday loan. Payday lenders can charge APRs of up to 400% and wrongly using it trap borrowers into vicious debt cycles. These loans are considered as predatory loans among community who actually felt in trap,It’s widely available, but they are such a dangerous financial proposition that many states prohibit or heavily regulate them. Keep this in mind as you compare lenders.

If you’re applying for a personal loans for bad credit, you will pay a higher APR than individuals with higher credit scores. That’s because the lender is taking on more risk by lending to you. But, if used responsibly, a personal loan from a reputable lender might help you to improve your financial situation over the time.

Advantages of a personal loans for bad credit

Here are some of the advantages of taking out a personal loans for bad credit.

- Clear payment plan: From the day you take out a personal loan, you know precisely how much your monthly payments will be and when the loan will be paid off (also known as the repayment term). This information can help you plan for your financial budget for every month leaving portion aside for loan repayment.

- Debt consolidation: You may be able to consolidate multiple higher-interest loan accounts into a single manageable loan, simplifying your life. In some cases, this can also lower your interest rate or even lower your monthly payment. This may mean stretching your payments over a longer period of time, but if, for example, you are facing bankruptcy, it might give you some breathing space.

- Give you the money you need, quickly: You have access to money when your water heater goes belly up or some other financial emergency creeps into your life. The process is fast, and funds are typically dispersed within one or two days.

- Avoid unscrupulous lenders: You can borrow from a reputable lender rather than deal with a payday lender.

- Build your credit: If you make your payments on time, a personal loan can help to build your credit. That may mean you qualify for a lower interest rate the next time you need a loan.

Even if your personal credit score isn’t perfect, you might benefit from a bad credit personal loan.

Disadvantages of personal loans for bad credit

Before making a financial decision, it’s essential to be aware of the disadvantages. Here are a few potential downfalls that can impact even the best personal loans for bad credit.

- You might not stop spending: Say you use a personal loan to pay off higher-interest credit cards. Once those cards have been paid off, nothing is keeping you from charging them back up. One disadvantage of a personal loan for bad credit is that you could end up with new credit card debt and a consolidation loan.

- The interest rate may be high: It can be discouraging to compare the interest rate you will be charged for your loan to the interest charged for the same loan to someone with good credit. You can’t do that. Make sure you have a solid plan for your loan, like getting rid of really high interest debt and building your credit score. Then, as long as you shop around for the best deal for your circumstances, you can stay focused on your own goals.

- You don’t make your monthly payments: If you commit to a loan you can’t afford, or your financial circumstances change, you may find yourself in a position where you can’t meet your obligations. This would hit your credit score even harder and leave you in a worse position.

- You may have to pay extra fees: Many personal loans charge an origination fee of between 1% and 8% of the loan. You may also find loans that charge prepayment penalties if you want to pay back your loan ahead of the loan term. Make sure you factor in all the costs when comparing loans. The best bad credit loans have minimal fees.

- You might have to put up collateral: Depending on your lender, you might need to put up collateral to get loan approval. This is known as a “secured loan,” and if you can’t make your monthly payment, the lender can seize your collateral to help cover their costs. If you want to avoid this, look for an unsecured personal loan.

Alternatives to personal loans for bad credit

One of the most interesting things about personal finance products is that there is no one-size-fits-all solution. We need to scan the landscape to figure out what works best for us, and personal loans are no exception. Here are a few alternatives:

Personal savings account: Having poor credit does not necessarily mean that you can’t put money away into an emergency fund, even if it’s a little at a time. As irritating as it can be to be reminded of the importance of saving, the ability to take money from your savings account rather than take out a loan will almost always save you money. And if you don’t need cash urgently, saving up is always a better option than taking on debt.

Cosigner: If you have someone in your life with strong credit, ask them to cosign your loan. A loan cosigned by someone with good or excellent credit will enjoy a better interest rate than one designed for a borrower with bad credit. Before asking someone to cosign, though, think long and hard. Remember that if you don’t pay, the cosigner will be responsible for your debt. If there is any chance that you will not be able to keep up with your payments, you could be putting an important relationship in jeopardy.

When your credit improves, you may also be able to qualify for a balance transfer card. This would let you consolidate high-interest credit card debt onto a card with a 0% intro APR.