Don't waste your time. Get a loan online.

personal loans for poor credit

Can you get personal loans for poor credit?

A bad credit personal loan is a short-term financial fix for consumers who need to borrow money but have a bad credit score or poor credit history.

Interest rates on personal loans for poor credit are higher – in some cases considerably higher – and terms are short, between one to five years. But consumers whose credit score is poor and have significant financial needs, may find this loan can help them get their feet back on the ground.

While checking personal loans for poor credit do not to focus on the interest rate. Instead look at the financial wherewithal it provides. But … do not take out any loan that does not fit your budget. Advice on budgeting and loans is available form a nonprofit credit counselor.

Consumers borrow what they need and then make regular monthly payments. The good news is the loan can be used for just about anything — from consolidating credit card debt to paying medical bills to buying a car to making a major repair to the home.

Don't waste your time. Get a loan online.

Finding a personal loans for poor credit can be a challenge.

If you are facing issue while getting personal loans for poor credit, and got rejection , what we suggest is you should first check your credit score first on your self this kind of inquiries is called soft credit check, and they wont be reflected in any credit report, its just for you to view your credit score.

If you find your credit score low then stop looking for personal loans for poor credit at traditional lenders such as banks and all, you should check the alternate way to borrow as listed below:

Credit Union :

Credit Union is non-profit government agency working in financial area. they lends money to their members based on their financial states with them, one more thing is anyone and everyone can be member of Credit union by applying through them with few donation to non-profit organizations.

Family and Friends :

It’s easy to qualify and hope fully has lower interest rate. In this case credit history or your score also matters least until you have maintained good relation with them. Yet this kind of borrowing leads to bitter relation in case of you failed to keep your promise and not able to pay back money in time.

Find a Co-Signer :

When your credit score does not allow you borrow you sufficient Cash you required at lower price then you should sign in with co-signer whose credit score is higher and sufficient. so this way you can be approved for amount you wish for and with interest rate which might be affordable and way below if you sign it just your self.

However this type of option has its own down side, like until your loan account is active your co-signer is not allowed to open another loan account even though he has high credit score, means he can not take loan if they required emergency cash then they must look to alternative option to borrow. and they are always in hook if you are ever not able to pay your loan then they should be responsible for the future payments of your repayments.

Online only Lenders :

You should also try applying to online only lenders. they have much more open than traditional lenders. they have less strict terms and conditions. though you should go through them carefully as some of the lenders out there have hidden fees associated with their lending so. you should consider this fact that you double check with lenders policy first.

What Is Considered a Bad Credit Score?

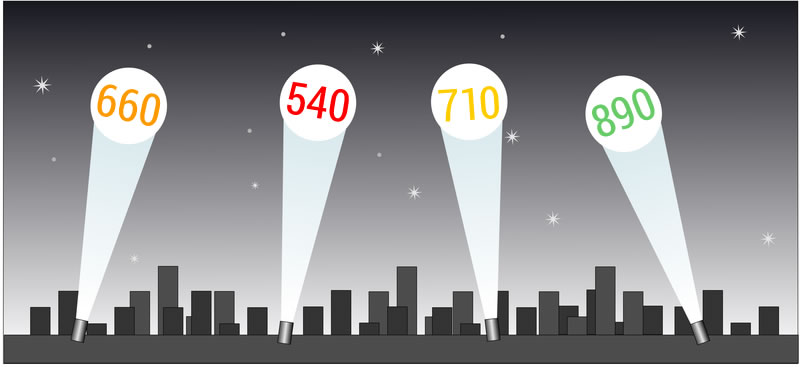

Credit scores range from 300-850 and though there is no official start to the “bad credit score” category, it’s safe to say if you’re under 650 you are considered a high risk, which means you will pay the highest interest rates.

People in this category are prime candidates for personal loans for poor credit.

The definition of a “good” and “bad” credit score does vary from lender to lender. Some won’t touch anyone with a credit score under 650; some actually market to consumers with a sub-650 score.

So it’s hard to say what makes you “good” or “bad” on the credit scoreboard, but the accepted range looks something like this:

- 760-850 – Excellent

- 700-759 – Very good

- 660-699 – Fair

- 620-659 – Poor

- Scores under 620 – Extremely poor

Common things to bring that prove your credit worthiness include:

- Tax returns, W-2s and 1099 forms from at least the last two years

- Details of your job history, including salary and pay stubs

- List of assets such as home, car, property and where you stand on paying them off

- List of unsecured debts such as credit cards, student loans and medical bills

- Whether you pay or receive alimony or child support

- Bank statements for checking, savings and CDs