Don't waste your time. Get a loan online.

Improve credit score no matter what. Credit scores are something cannot be taken for granted, particularly when it’s low. Because a high credit score is one of the primary factors for obtaining credit and loans with better terms and lower interest rates, it is important to find effective ways to improve your credit score.

Below are a few of the most effective methods of improving the score of your credit:

1. Verify your credit score

If you’re in the minority with a bad rating on credit, then the very first thing to do is take an account of your credit report applying on the site of CIBIL. After that, you must examine your credit report and determine whether all details in the name of yours is accurate and current. If you spot any mistake in the credit reports you must notify CIBIL immediately to ensure your credit score will not negatively affected.

2. Pay on time

Another way to boost your score on credit is to settle your bills in time. Make sure you aren’t paying only the minimum amount due it is recommended to repay the entire amount as soon as you can. Your payment history is the majority of the credit rating, therefore it’s crucial to make sure you don’t miss payments. If, however, you find it difficult to timely payments, think about automating your payments on your accounts , or creating reminders for payments.

Don't waste your time. Get a loan online.

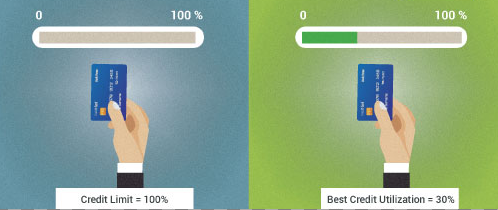

3. Keep your credit utilization ratio low

It is recommended that you keep the ratio of your credit card to less than 30 percent. Make sure you do not make use of your credit card for any transaction. When you follow this rule you will notice an increase in your score on credit.

4. Do not continue to apply for a loan after being the loan is rejected

If you’ve applied for a loan but the application was denied at the request of the loan provider, the details will be noted in the credit file. If you seek a loan another credit from a different lender right away they will notice your credit score as low and the previous rejection of loans on your credit history. Therefore, the lender could decide to reject your application. The best course of action in the event of a rejection is to make a second application and be patient and wait in the hope that your credit rating will improve.

5. Limit the amount you borrow to the bare lower

If you’re making too many applications for loans or credit cards your credit score will be likely to be impacted since these actions indicate a credit-hungry attitude. The best option is to take out the loan only when it is necessary.

6. Old accounts should be kept open

If you are trying to boost your score on credit, try not closing accounts you have had that you have paid off, even if you don’t use them anymore. Keep your old accounts in good standing will assist you in keeping the credit history eventually results in better credit score.

These are some of the most effective ways to boost the credit rating of your. But, it’s important to keep in mind that these suggestions won’t immediately assist you increase the credit rating. Once you have implemented these tips, it can take anywhere from 6 months to one an year before your score begins to increase.