Don't waste your time. Get a loan online.

getting payday loans in 2021, things no one will tell you, how you could take payday loans and repay back without affecting or damaging your financial condition.

Quick Payday loans at Motiveloan is a simple, fast, and dependable way to apply for cash when you need it the most.

A payday loan is a small, short-term loan that is due to be paid back, the next time you receive a paycheck. Payday Loans – also called cash advances or Quick payday loans – are primarily made for those who seek money to cover emergency expenses or other financial obligations that might come up between next salary date.

How it works:

- APPLY ONLINE WITH OUR QUICK ONLINE APPLICATION.

- RECEIVE A QUICK LENDING DECISION.

- REVIEW AND SIGN YOUR LOAN AGREEMENT. (if approved)

- GET INSTANT CASH

- PAY BACK ON YOUR NEXT PAYDAY

What do I need to apply?

- Valid government-issued photo ID

- Working phone number

- Steady source of income

- Bank account

APR explained

You may have heard from your friend or some online resource that Quick Payday loans have high APRs, True! Payday loans has that feeling and we get that why payday loan has that face value for payday loan and do make comments like that, actual point is They never been in situation where they have poor credit and required cash urgently.

Don't waste your time. Get a loan online.

That is the sole purpose of Quick Payday loan, It is for people who have less credit and don’t have access to traditional way of borrowing from banks.

Here is why high APRs on Quick Payday loans should the thing you should worry about or get scary of. (you can calculate it your self)

WHAT IS “APR”?

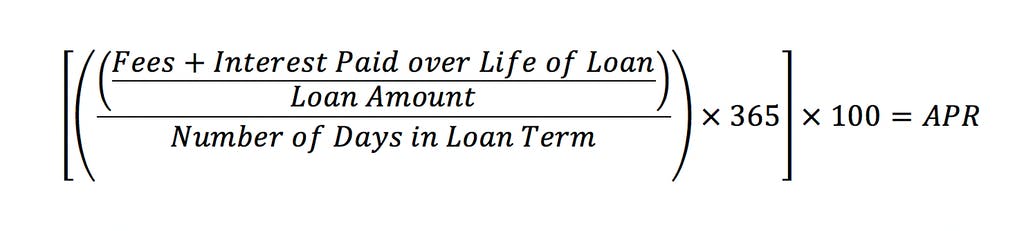

APR, or annual percentage rate, is an interest rate for a whole year rather than a bi-weekly or monthly rate.

WHY IS IT SO HIGH ON QUICK PAYDAY LOANS?

Quick Payday loans are often associated with high annual percentage rates (APR). APR is what you would be paying if you had the loan out for an entire year. But a typical payday loan is meant to be just that — a loan until your next pay date. So days you actually got money borrowed is very less(7 to 14 days) So typically your loan principal (the amount of cash you borrow) plus finance fees are due to be paid back on your next payday.

When to consider a Payday Loan

A payday loan is like a band aid — a temporary solution for a short-term cash requirements. They are an expensive form of credit and should ONLY be used for emergencies or necessities. Think of them as a last option.

Usually people have this questions in their mind let us clear for you

When will i get my loan funds

We offer funding to a debit card for eligible Customers! If you prefer to get cash, apply online and if approved, we may credit it to your checking account withing next 2 business days! (availability depends on your bank).

When will i have to pay back my loan

Payday loans are typically due to be paid back around your next payday, which is usually 7-14 days away, depending on your pay schedule. The amount due includes the principal amount you borrowed plus finance fees.

Can i get payday loan with bad credit

No one is perfect. Every one at some point of life need emergency cash, That’s why we offer loans to people with all types of credit scores.

When a Payday Loan may not be ideal option

- When you need a big amount, payday loan is not designed with that purpose.

- When you need an extended amount of time to pay back the money you borrow

- When you need to borrow money time and time again.

- Non-essential purchases (such as buying the latest and Exotic TV set, taking a vacation, or buying holiday gifts)

Find the Most Trusted Payday Loans Online

Of all of life’s expenses, an unexpected one can turn your life upside down. Emergency cash from a payday lender can help, provided you’re able to repay it soon and don’t need it to cover regular expenses.

The online lending marketplaces we’ve reviewed should be a good start in finding a payday loan with terms you can afford. They’re easy to apply for and often can have the cash to you within a day.

Borrowers with bad credit can often qualify for payday loans. The interest rates can be high, however, so it’s worthwhile to repay the loan quickly and on time to avoid paying more than you need to. But for an emergency loan that you need quickly, a payday loan can be a viable solution.